japan corporate tax rate 2017

The inhabitants tax charged by both prefectures and municipalities comprises the corporation tax levy levied. 338 Treatment of losses.

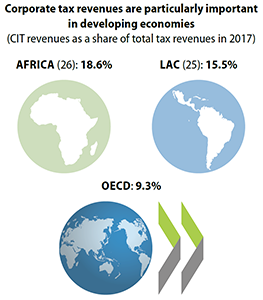

Corporate Tax Statistics Third Edition Oecd

Tax year 2015 1 Tax year 2016.

. Tax year beginning after 1 Apr 2018. For fiscal periods beginning on or after 1 April 2015 until 31 March 2017 an RD tax credit of generally between 8 and 10 of RD expenditure is available up to 25 of corporate taxable. Tax year beginning between 1 Apr 201631 Mar 2017.

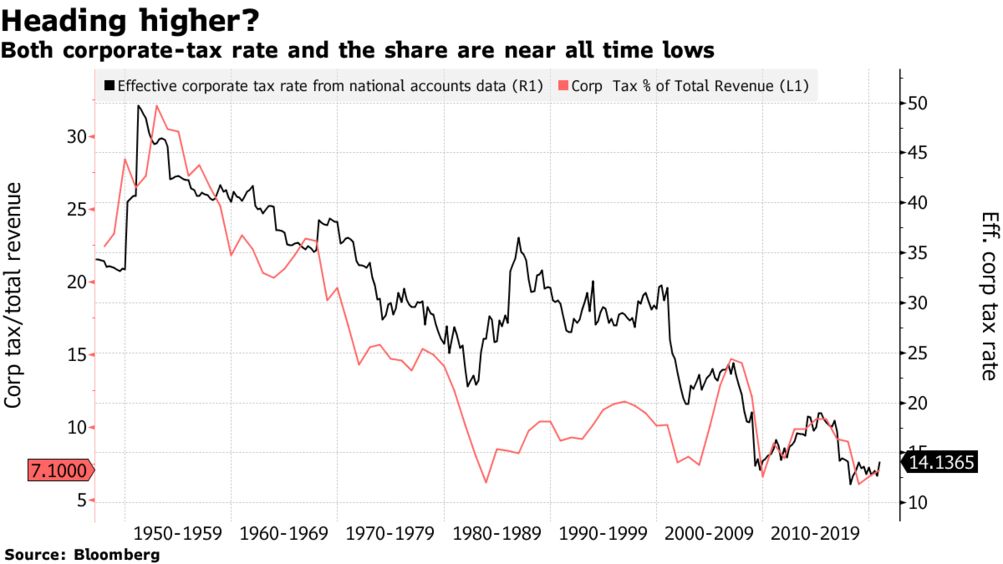

Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019. Whether these cuts have had the desired impact so far is not clear. The worldwide corporate tax rate has declined significantly since 1980 from an average of 38 percent to 2296 percent.

55 of taxable income. Japan Corporate Tax Rate for Dec 2017. Corporation tax is payable at 239 percent.

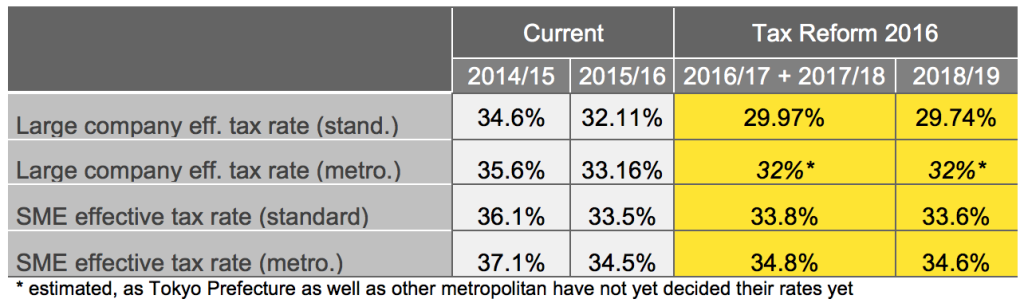

Today it stands at 2997 with plans to trim it further to 2974 next year. The corporation tax is imposed on taxable income of a company at the following tax rates. The corporate tax rate in Japan for a branch is the same as for a subsidiary.

Tax year beginning between 1 Apr 201731 Mar 2018. Limitation ratio for large corporations. Tax Rate Applicable to fiscal years Corporation tax is payable at 2 beginning between 1 April 2017 and 31 March 2018 Tax rates for companies with stated capital of JPY 100 million or greater are as follows.

115-97 replaced the graduated corporate tax structure with a flat 21 corporate tax rate and repealed the corporate alternative minimum tax AMT effective for tax years beginning after December 31 2017. Interest on corporate bonds issued by a Japanese company that is paid to a non-resident bondholder either a non-resident company or a non-resident individual is generally subject to Japanese withholding tax at the rate of 15315. The tax credit for the promotion of income growth and the tax credit for job creation may be taken in the same fiscal year if certain adjustments are made.

4890 Dec 31 2015. However if the taxable earnings exceeds this amount a rate of 15 is charged on the amount in excess of 30 million yen and up to 100 million yen and any amount in excess of 100 million yen is taxed at a rate of 20. But if the company is Medium and small sized company the taxable income limitation does not apply.

Dec 31 2017. 96 67 96 70 Local corporate special tax or special corporate business tax the rate is multiplied by the income base of size-based enterprise tax which is national tax. The latest comprehensive information for - Japan Corporate Tax Rate - including latest news historical data table charts and more.

Effective Corporate Tax Rates With Uniform and Country-Specific Rates of Inflation in G20 Countries 2012 37 Figure B-4. Tax rates for companies with stated capital of JPY 100 million or greater are as follows. 60 of taxable income.

Our company registration advisors in Japan can deliver more details related to the corporate tax in this country. Current Japan Corporate Tax Rate. The United States statutory corporate income tax rate is 1592 percentage points higher than the worldwide average and 95 percentage points higher than the worldwide average weighted by gross domestic product GDP.

World Bank Japan Japan Corporate Tax Rate. 50 of taxable income. 5040 Dec 31 2013.

4740 Dec 31 2016. Effective Corporate Tax Rates With Alternative Rates of Inflation in G20 Countries 2012 35 Figure B-3. Local corporation tax applies at 44 percent on the corporation tax payable.

At present Japans corporate tax rate is 3211 percent. Tax base Small and medium- sized companies 1 Other than small and medium-sized companies Taxable income up to JPY8 million in a year 19 15 2 234 3 Taxable income in excess of JPY8 million 234 3. 1 If a company has capital in excess of 100 million Japanese yen or is a wholly owned subsidiary of a large corporation with capital of more than 500 million Japanese yen the company is treated as large corporation under corporate tax.

The government initially planned to reduce the rate to below 30 percent in fiscal 2017 after cutting it to 3133 percent in fiscal 2016. Effective Corporate Tax Rates With Alternative Allocations of Asset Shares in G20 Countries 2012 34 Figure B-2. Rate The national standard corporation tax rate of 232 applies to ordinary corporations with share capital exceeding JPY 100 million.

50 2 Carryover period for loss utilisation as well as assessment by tax authorities and request for downward adjustment by taxpayer assuming loss period financial documentation is maintained 9 years. However under section 15 corporations with fiscal tax years beginning before January 1 2018 and. Since then the rate peaked at 528 in 1969.

Companies also must pay local inhabitants tax which varies with the location and size of the firm. Measures the amount of taxes that Japanese businesses must pay as a share of corporate profits. 1 2018 the corporate tax rate was changed from a tiered structure that staggered corporate tax rates based on company income to a flat rate of 21 for all companies.

4880 Japan Corporate tax rate. Japans Prime Minister Shinzo Abe has taken the axe to corporate taxes more than once over the course of his tenure. Tax rates for fiscal year filers.

When Abe took office in 2012 Japans corporate tax rate stood at 38. Local corporation tax applies at 103 percent on the corporation tax payable. The local standard corporate tax rate in Japan is 234 and it applies to normal companies with a share capital which exceeds JPY 100 million USD 896387.

Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. 73 51 73 53 Over JPY 8 million. If the annual taxable earnings does not exceed 30 million yen it is subject to a tax rate of 10.

5040 Dec 31 2014. The federal corporate income tax was fist implemented in 1909 when the uniform rate was 1 for all business income above 5000.

Japan Tax Reform 2016 Japan Industry News

Chapter 2 Modernizing The Tax Policy Regime In Modernizing China

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

An Overview Of The Taxation Of Residential Property Is It A Good Idea Public Sector Economics

Trump Tax Plan Halts Inversions But Increases Treaty Shopping Vox Cepr Policy Portal

Corporate Tax Reform In The Wake Of The Pandemic Itep

Biden Tax Plan Aims To End Trump S Corporate Tax Cut Party Bloomberg

Japan S Carbon Tax Policy Limitations And Policy Suggestions Sciencedirect