corporate tax increase uk

In order to support the recovery the increase will not take effect until 2023. By RJP LLP on 9 November 2021.

Location Matters Effective Tax Rates On Corporate Headquarters By State Freedom Day Freedom Tax Day

Companies whose profits do not exceed the lower profits limit set at 50000 pay corporation tax at the small profits rate which remains at the current corporation tax rate of 19.

. This current Budget has been presented against the backdrop of nationwide lockdown and spiraling national debt. Where the taxable profits can be attributed to the exploitation of patents a lower effective rate of tax applies. 30 Increase for Some Businesses The Corporation Tax increase will mean 6p more in every 1 or an increase of over 30.

The normal rate of corporation tax is 19 for the financial year beginning 1 April 2021 and will be maintained at this rate for the financial year beginning 1 April 2022. OECD Statutory Corporate Income Tax Rates United Kingdom UK HMRC corporation tax onshore and offshore. This measure also announces that from 1 April 2023 the Corporation Tax main rate for non-ring fenced profits will be increased to 25 applying to.

Businesses with profits of 50000 or less around 70 of actively trading companies will continue to be taxed at. In April 2023 the rate of corporation tax will increase to 25 a 6 increase from the current 19 while at the same time creating a small profits rate for businesses with less than 50000 profit who will continue to pay corporation tax at the current 19 rate. Corporation Tax Rate Increase in 2023 from 19 to 25.

New Chancellor to review planned corporation tax increase Nadhim Zahawi who replaced Rishi Sunak after his shock resignation on Tuesday evening said everything is on the table. Boris Johnson could call on the new Chancellor to cut taxes or roll back. Furthermore if you pay your corporation tax late dont pay enough or dont pay at all HMRC will charge you late payment interest.

The hike in corporation tax is expected to raise an additional 22bn in revenues a year with the tax take. The main Corporation Tax rate is increased to 25 and will apply to companies with profits in excess of 250000. The new rate will be effective from 1 April 2023.

The rate of corporation tax paid on company profits is to rise to 25 from 19 starting in 2023. Currently all companies regardless of the size of their profits suffer corporation tax at the rate of 19. Businesses earning profits between 50000 to 250000 will be able to claim marginal relief which was long forgotten about a decade ago.

Britain will raise its corporation tax on big companies to 25 from 19 from 2023 the first hike in nearly half a century but will temper. From 1 April 2023 an increase from 19 to 25 in the main rate of corporation tax and the introduction of a 19 small profits rate of corporation tax for companies whose profits do not exceed GBP 50000. Prior to this the two reforms to capital allowances were forecast to cost 123 billion in 202122 rising to 127 billion the following year.

First the Chancellor proposed raising the corporate income tax rate from 19 percent to 25 percent in 2023. Another 10 of any unpaid tax. However it is thought this could now be reassessed as the Prime Ministers future comes under pressure from ministers.

The marginal relief acts to adjust the rate of tax paid gradually increasing liability from 19 to 25. The rate is 10. Chancellor Rishi Sunak said it was fair.

5 hours agoThe corporation tax rate is set to increase from 19p to 25p in April as part of a move designed to raise around 17bn each year for Treasury coffers. For UK companies one of the biggest taxes to be planning ahead for is the increase to corporation tax. Companies with profits between 50000 and 250000 will pay tax at the main rate of 25 reduced by marginal relief.

If your tax return is late three times in a row the 100 penalties increase to 500 each. The 2021 UK budget announced by the Chancellor of the Exchequer Rishi Sunak on March 3 2021 included two important corporate tax provisions that will impact incentives for business investment. 10 hours agoBritains new finance minister Nadhim Zahawi said on Wednesday he would look at everything when considering whether to continue with a.

The 2021 Budget report estimated the new rates of corporation tax would raise 119 billion in 202324 rising to 172 billion in 202526. In the long-term the United Kingdom Corporate Tax Rate is projected to trend around 2500 percent in 2023 according to our econometric models. As a result of the corporation tax rate increase the full rate of 25 will be applicable to businesses making profits of over 250000.

Corporate Tax Rate in the United Kingdom is expected to reach 1900 percent by the end of 2022 according to Trading Economics global macro models and analysts expectations. The rate from 4. For the financial year 2023 starting on 1 April 2023 the main rate of corporation tax will increase to 25 for companies whose profits exceed the upper profits limit set at 250000.

With the recent Budget the UK government intends to increase the corporation tax to 25 in April 2023 a 6 increase from the current tax.

How To Start A Business In The Uk Starting A Business Starting Your Own Business Business Infographic

Inheritance Tax In The Uk Explained Infographic Inheritance Tax Inheritance Infographic

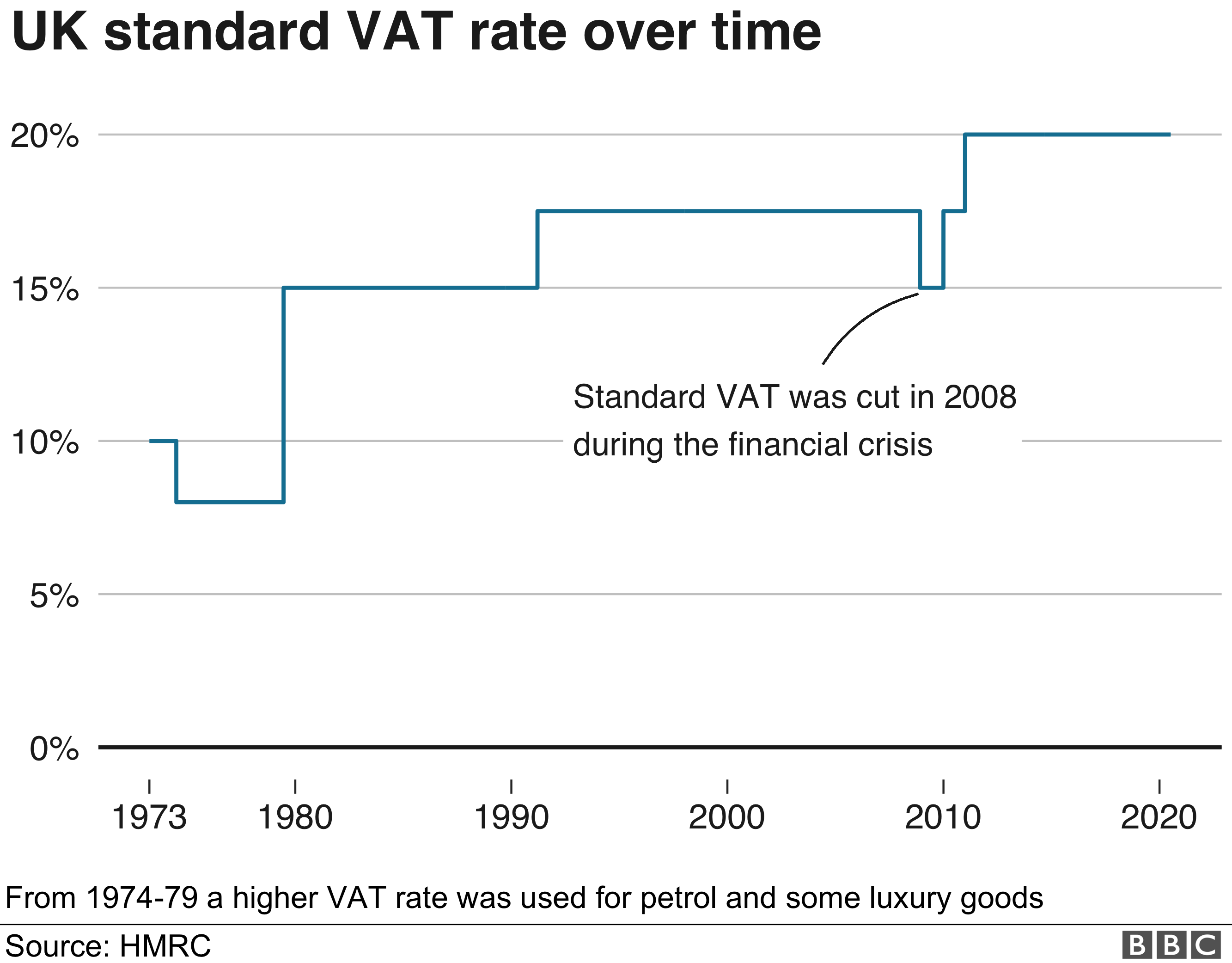

What Is Vat And How Does It Work Bbc News

Corporate Income Tax Definition Taxedu Tax Foundation

Us Corporate Tax Rate Compared To Other Countries Business Infographic Small Business Infographic Infographic

How To Reduce Corporation Tax Bill Using Simple Practices Business Infographic Corporate Tax

Richard Burgon Mp On Twitter Richard Investing Twitter

United Kingdom Corporation Tax Wikipedia Financial Instrument Corporate United Kingdom

Council Tax Increase Why Am I Paying The Police So Much How To Raise Money Data Journalism Social Care

Bilalhashmat005 I Will Do Bookkeeping On Clearbooks Online For 5 On Fiverr Com Bookkeeping Financial Statement Income Tax Return

Importance Of Cost Accounting In The Medical Practice Http Www Harleystreetaccountants Co Uk Importance O Cost Accounting Company Structure Medical Practice

78 Of Small Businesses Say Higher Taxes May Cause Them To Downsize Survey Says Small Business Trends Business Online Surveys

5 Businesses Running Rings Round Hmrc Tax Research Uk Infographic Corporate Business

Stamp Duty Land Tax For Limited Companies In Uk In 2022 Stamp Duty Stamping Companies Company

Top Money Paid By Clickbank And Clicksure Go To This Website Http Im 6p3qdhcw Yourreputablereviews Com Charts And Graphs Tax Return Graphing

How To Fund Basic Income In The Uk Part 3 Carbon Tax And Dividend Land Value Tax Dividend Income